Roommates, we see the memes about debt and financial woes — and occasionally, we laugh along, but let me be the annoying “be your higher self” friend real quick and let’s get into striving toward Financial Stability all while watching your timeline living their best lives. I came across this book that basically walks you through staying in your own lane and letting it benefit your pockets– more specifically as it relates to freeing yourselves from student loan debt.

I thought we could all use some of the gems in this book like these quick fun facts about student loan debt! According to the book, Don’t Let The Internet Make You Broke:

-“It takes away from the average retirement.”

-“Each additional dollar in student loan debt decreases your retirement savings by 35 cents. This means someone with $100k in student debt loses about $35k of their retirement on average.”

– You can low-key finesse the credit bureau in “thinking you’re responsible.” “You already owe thousands, might as well get something out of it, right?” the book’s author, Raymond Smith writes as he recollects his journey to attack $50k worth of student debt off in only four years.

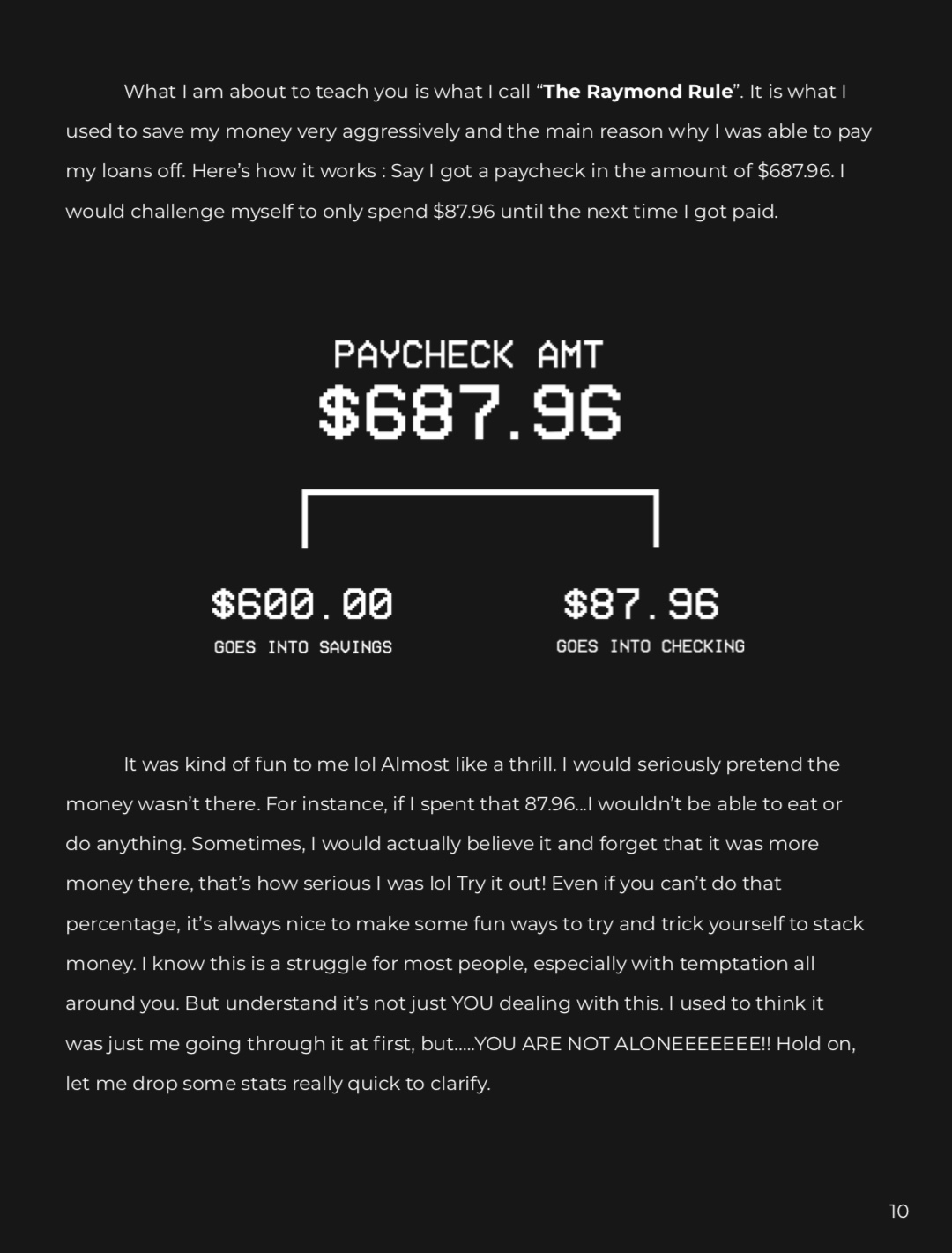

Y’all don’t want to forget about flexible bills, like a social bill, lifestyle bill, family and friends bill, even an alcohol bill. These are all places you can cut back your spending to contribute to your savings. What happens next is referred to in the book as “The Raymond Rule.” It’s a template to follow how to aggressively build your savings. According to The Raymond Rule, if your paycheck is $687, you put $600 in your savings, and use the $87 to survive on until the next paycheck.

I know that seems like a small amount to give yourself — especially compared to the amount that you put into your paycheck. However, it’s the exact template Raymond followed to eliminate his $50K worth of student debt.

All in all, the book was dope! I appreciated the realness of learning to stay in your lane regardless of the hours of best life you see being lived on your timelines. Financial literacy is something we value here at The Shade Room, so the knowledge is appreciated.

If you’re on that journey of getting these loans out of the way, the book is an amazing resource.

Would you try the “Raymond Rule,” Roommates?!

Join the conversation on Instagram!

TSR STAFF: Chantel Kelli! @_popchanny!