A Black college professor who studies housing discrimination is suing after his home appraisal jumped nearly $300,000 upon removing his race from a refinancing loan application.

Nathan Connolly and his wife Shani Mott were looking to refinance their Baltimore home, which was initially estimated to be worth $472,000. A mortgage lender then denied a refinance loan.

However, after the John Hopkins University professor and his wife removed any indications that Black people lived in the home, a second appraiser valued it at $750,000, according to the New York Times.

Leading Expert In Housing Discrimination Is Discriminated Against When Trying To Refinance Baltimore Home, Case Claims

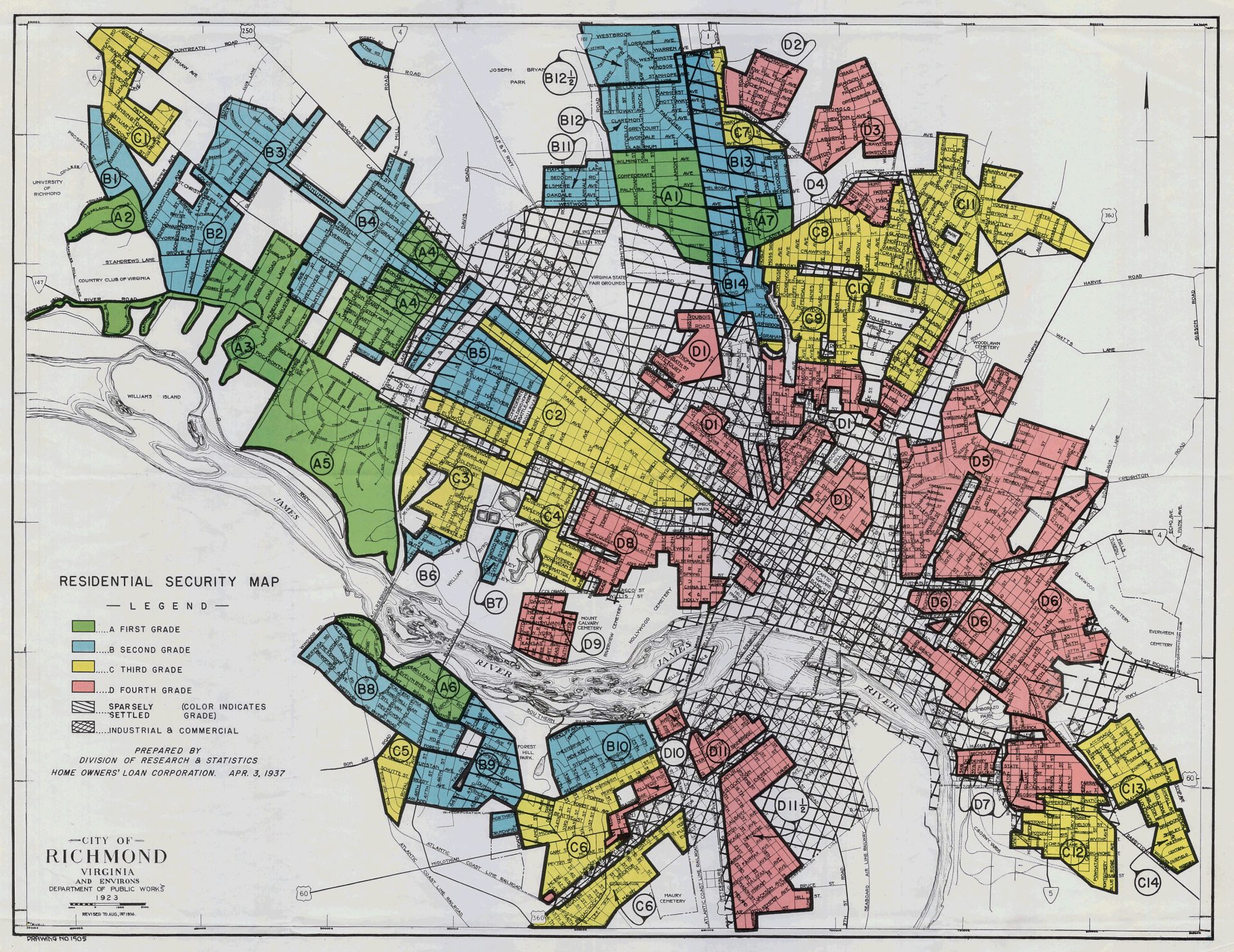

Ironically enough, Connolly is a leading expert in the field of redlining, which is when a bank or insurance company refuses to loan to “someone because they live in an area deemed to be a poor financial risk.”

Last summer, Connolly and his wife had added a new $5,000 tankless water heater amongst $35,000 in other home renovations.

We are very excited for Nathan Connolly's Blood and Soil: Real Estate and Racism in Modern American History! This will be an insightful talk that you will want to hear!

.

.

.#AfricanAmerican #Racism #UniversityofOklahoma #Equality #NathanConnolly #BlackAmerican #ClaraLuper pic.twitter.com/9g4nywFilT— African & African American Studies (@AFAM_OU) October 12, 2018

The property had been worth about $450,000 when they bought in back in 2017, but since the COVID-19 pandemic, housing prices have soared nationwide.

In Baltimore alone, homes have gone up in price 42 percent over the last five years, according to Zillow.

Denied Loan, Home Undervalued Before Removing All Traces Of Race, Complaint States

So the couple said they were stunned when a Maryland appraisal company valued their home at only $472,000, and similarly stunned when loanDepot, a mortgage lender, denied the couple’s refinance loan application.

The Times reported that Connolly and Mott challenged the appraisal with a lending officer at loanDepot, who eventually stopped responding to them, per the complaint.

Several months later, the couple applied for another refinance loan.

But this time, they removed all family photos from the home, and had a white professor from Johns Hopkins pretend to be the homeowner.

The home was then valued at $750,000 by the second appraiser.

The couple’s lawsuit cites loanDepot, 20/20 Valuations and it’s owner Shane Lanham, who reportedly conducted the first appraisal.

No surprise, but this @JHU_Cities talk with @rmarchiel and Nathan Connolly rn is 🔥🔥🔥 pic.twitter.com/W3F0dcc8ks

— Dylan Gottlieb (@dygottlieb) November 19, 2020

“Dr. Connolly, Dr. Mott, and their three children were home during the visit, and their house was also filled with family photos, children’s drawings of figures with dark skin, a poster for the film Black Panther and literature by Black authors,” the complaint reads.

Lawsuit Claims Other Homes Were Appraised Higher To Connolly’s Home, But Were Of Lower Quality In Comparison

The couple’s complaint goes on to say during the first application for a refinancing loan, “it would have been obvious to anyone visiting that the home belonged to a Black family,” calling it “an absolute gut punch” to know that “our presence and the life we’ve build in our home brings the property value down.”

“It would have been obvious to anyone visiting that the home belonged to a Black family,” the complaint reads.

“We were clearly aware of appraisal discrimination,” Connolly said. “But to be told in so many words that our presence and the life we’ve built in our home brings the property value down? It’s an absolute gut punch.”

The complaint adds that other homes that were appraised higher to Connolly and Mott’s home were of lower quality in comparison, and the appraisal incorrectly reported that their home hadn’t received any updates or renovations in 15 years, according to the Times.

Lanham “cherry-picked low-value homes as comps,” and “ignored legitimately comparable homes with much higher sales prices” in the process, the complaint claims.

“Redlining” Continues To Be Common Practice, And Drives Down Home Values In Black Neighborhoods

The issue of redlining continues to be common practice and drives down home values in Black neighborhoods across the country.

And Black Americans are denied mortgages at much higher rates than their white counterparts, studies show.

Black homeowners not only have primary mortgages with higher interest rates than white homeowners with similar incomes, they also have higher interest rates than white homeowners with substantially lower incomes, according to Harvard Joint Center for Housing Studies Raheem Hanifa’s analysis of data from a 2019 American Housing Survey.

Baltimore, a historically and majority Black city, has long suffered in terms of race and housing, with a 31 percent gap in homeownership when compared to whites within the city, NPR reports.

And upwards of 15,000 homes are vacant or derelict within city limits, per a June Associated Press report.